- 2025,09,15

Chairman Yan Yiyi (second from right), Director and General Manager Ren Bingjun (second from left), Deputy General Manager and Board Secretary Ke Zehui (first from left), and Financial Director Lv Sunzhan (first from right)

1.Over 300 million yuan in revenue in the past three years

Data shows that the operating revenue of Cheng Yi Pharmaceutical has remained around 300 million yuan in the past three years. The company expects its operating revenue to be between 85.5 million yuan and 94 million yuan in the first quarter of 2017, with a growth rate of 21% to 33%; The net profit ranges from 13 million yuan to 14.2 million yuan, with a growth rate of 14% to 24%.

Cheng Yi Pharmaceutical is mainly engaged in the research and development, production, and sales of chemical drug raw materials and formulations. In the past three years, the proportion of sales of raw materials has shown a slow decline, dropping to 34.70% in 2016.

In terms of preparations, the sales proportion of capsules has been increasing year by year, reaching 40.91% in 2016.

2.There are three major measures to address the "two vote system"

It is reported that currently, Cheng Yi Pharmaceutical's product sales mainly implement the "two ticket system" policy in Fujian and Xinjiang regions. The company stated that after implementing the "two ticket system" policy in the Fujian region, the sales unit prices of its main products have significantly increased, and while the sales quantity remains unchanged, the sales revenue has increased significantly. It is expected that after the implementation of the "two vote system" policy nationwide in the future, the company will not have any adverse impact on business performance due to the implementation of the "two vote system" policy.

At present, the sales revenue of the company's pharmaceutical products accounts for about 50% of the main business revenue, among which the sales revenue of pharmaceutical products affected by the "two ticket system" policy accounts for about 10% of the main business revenue. If the "two ticket system" policy is further promoted nationwide, Torasemide formulations can be transformed from a general distribution model to a sales model suitable for the "two ticket system" policy.

In order to actively respond to the expansion of the promotion scope of the "two vote system" policy, Cheng Yi Pharmaceutical has summarized the experience of implementing the "two vote system" in Fujian and plans to implement three response measures:

Firstly, the company has established its own regional dealer network for promotion and sales. Cheng Yi Pharmaceutical stated that the company will invest more resources in the sales process, further optimize the existing regional dealer network, deepen and refine the distribution network layout, expand sales coverage areas, and strengthen market promotion. One of the projects invested with the raised funds, the "Marketing Network Construction Project", is a measure taken to address the "two vote system".

Secondly, integrate the existing total distributor resources and encourage them to become marketing and promotion service providers for the company. The general distributor has shifted from being a direct customer of the company to providing market promotion services such as customer development, tracking, and maintenance. Thus achieving a smooth transition of the company's main products from a general distribution model to a "two ticket system" sales.

Thirdly, seek complementary advantages with pharmaceutical distribution companies. Expand the company's distribution network through mergers, acquisitions, and other means.

3.The main varieties have a high market share in the domestic market

Cheng Yi Pharmaceutical's main preparation products include Glucosamine hydrochloride capsules, tolasemide injection and capsules, Ribavirin injection and capsules, Aciclovir capsules, etc.

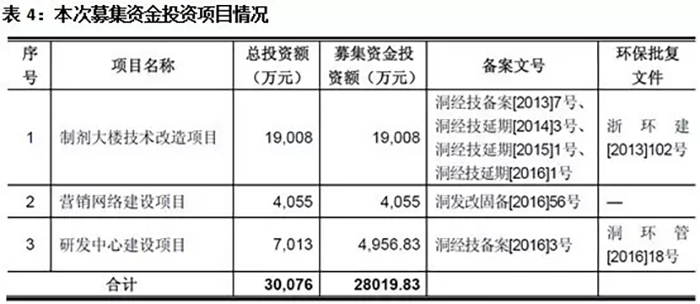

According to the data from Mi Nei Wang, in 2015, the chemical pattern of China's urban public hospitals, county-level public hospitals, urban community centers and township hospitals (hereinafter referred to as "China's public medical institutions"), anti-inflammatory drugs and anti rheumatic drugs market, Glucosamine hydrochloride capsules and Glucosamine hydrochloride tablets were among the top 20. Among them, Glucosamine hydrochloride capsules are OTC varieties, and their sales in the retail market are also considerable.

According to the prospectus data, the top four domestic manufacturers of hydrochloric acid grape preparations are Cheng Yi Pharmaceutical, Jiangsu Zhengda Qingjiang Pharmaceutical Co., Ltd., Aomei Pharmaceutical, and Shanxi Zhongyuanwei Pharmaceutical Co., Ltd. According to the statistics of the punctuation information of CFDA South, the market share of the products of the top four manufacturers in 2015 totaled 79.66%, and the market share of the company's Glucosamine hydrochloride preparation rose from 9.97% in 2011 to 26.11% in 2015, ranking first.

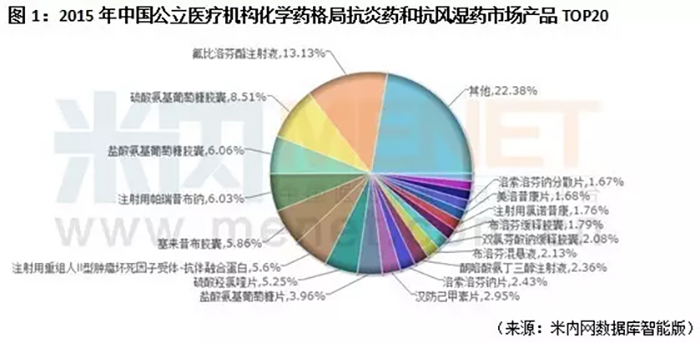

According to the data from Minnet, in the chemical drug market of China's public medical institutions in 2015, tolasemide for injection, tolasemide tablets, tolasemide capsules, and tolasemide injection all entered the top 20 product pattern.

According to the prospectus data, the top three domestic manufacturers of Tolasemide preparations are Nanjing Youke Pharmaceutical Co., Ltd., Nanjing Haichen Pharmaceutical Co., Ltd., and Zhejiang Cheng Yi Pharmaceutical Co., Ltd. According to the statistics of CFDA Southern's punctuation information, the top three manufacturers had a total market share of 84.94% in 2015, and the company's market share of Tolasemide preparations was 12.39%, ranking third.

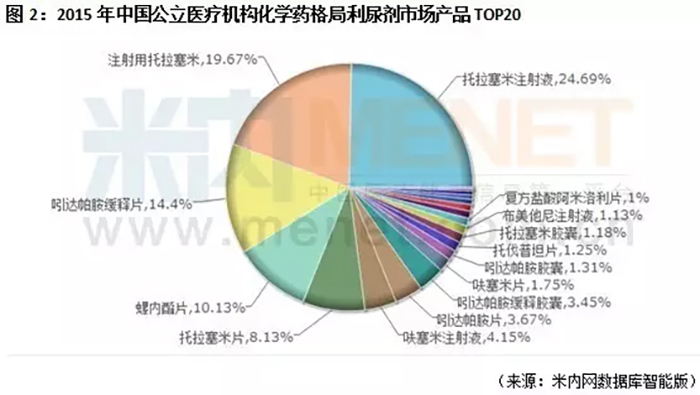

4.Raised 336 million yuan to invest in the technical renovation project of the preparation building

Cheng Yi Pharmaceutical is expected to raise a total of 335.688 million yuan in this issuance, with an estimated net amount of 280.1983 million yuan. The largest project invested with raised funds is the technical renovation project of the preparation building, which mainly involves the construction of a production line and related auxiliary production facilities with a total designed production capacity of 90 million ampoule bottles per year for small capacity injections, 210 million tablets per year, 950 million capsules per year, and 120 million packages per year for granules.

After the completion of the raised funds investment project, the company's production capacity will increase by 15 million injections per year, 210 million tablets per year, 600 million capsules per year, and 120 million packs per year of granules. Through the technical transformation project of the preparation building, the production capacity of the company's main products Glucosamine hydrochloride preparation and tolasemide preparation has been significantly improved. While expanding the production capacity of the original advantageous products, the company will plan to produce some new preparation products with strong potential market demand, expand new dosage forms and specifications, which will help to further expand the market share of existing products and gradually form a multi-level and rich product structure of the company.

In addition, through the construction of research and development centers, the company's new drug research and development capabilities and experimental testing capabilities are further enhanced. Through marketing network construction projects, further expand the company's existing marketing coverage area and deepen the marketing network layout in key areas. Overall, the investment project through this fundraising will enhance the company's overall research and development, production, and sales capabilities, continuously promoting the company's sustained and stable development.